fidelity tax-free bond fund by state

Ad Seek More From Municipal Bond Funds. Learn About The Tax-Exempt Bond Fund of America.

Best Municipal Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

Before investing consider the funds investment objectives risks charges and expenses.

. Research current and historical price charts top holdings management and full profile. Normally not investing in municipal. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other mutual funds.

Fidelity California Limited Term Tax-Free Bond Fund Fidelity. Find the latest Fidelity Tax-Free Bond FTABX. XNAS quote with Morningstars data and independent analysis.

Information for state tax. Ad Seek More From Municipal Bond Funds. The income from these bonds is generally.

Ad Search For Info About Fidelity tax free bond fund. Explore our highly-rated tax free muni bond fund. Ad Zero Minimums for Retail Brokerage Accounts Zero Account Fees from Fidelity.

Employs credit analysis yield curve positioning and sector rotation to unlock value. Our Curated Customizable Education Resources Can Help You Become a Smarter Investor. Learn About The Tax-Exempt Bond Fund of America.

Learn more about mutual funds at. Employs credit analysis yield curve positioning and sector rotation to unlock value. The Fund seeks to provide a high current yield exempt from federal income tax by investing in investment-grade municipal debt securities.

Explore our highly-rated tax free muni bond fund. Ad Keep more of what you earn. This Fund is managed to have an overall.

Get quote details and summary for Fidelity Tax-Free Bond Fund FTABX. See Fidelity SAI Tax-Free Bond Fund performance holdings fees. Gain market insights and learn the latest news about Municipal Bonds Muni Bond ETFs.

Stay up to date with the current NAV star rating. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Discover Must-Read Insights To Help You Navigate Todays Market.

Ad Discover industry trends market insights and gain knowledge about Municipal Bond ETFs. Discover Must-Read Insights To Help You Navigate Todays Market. The income from these bonds is generally free from federal taxes.

Browse Get Results Instantly. Ad Keep more of what you earn. Fidelity provides tax information about our mutual funds for your reference including state tax-exempt income data as well as information on international funds and corporate actions.

Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax. See Fidelity SAI Tax-Free Bond Fund FSAJX mutual fund ratings from all the top fund analysts in one place. L Fidelity Tax-Free Bond Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve.

To get the state-tax benefit these portfolios buy bonds from only one state.

How To Find Bargains In Municipal Bond Funds

There S More To Value Investing Than Low Prices Morningstar Value Investing Investing Ishares

Retirement Bucket Approach Cash Flow Management Fidelity Cash Flow Saving Goals Retirement

7 Of The Best Fidelity Bond Funds To Buy

7 Of The Best Fidelity Bond Funds To Buy

Where Did Fund Investors Put Their Money In July Morningstar

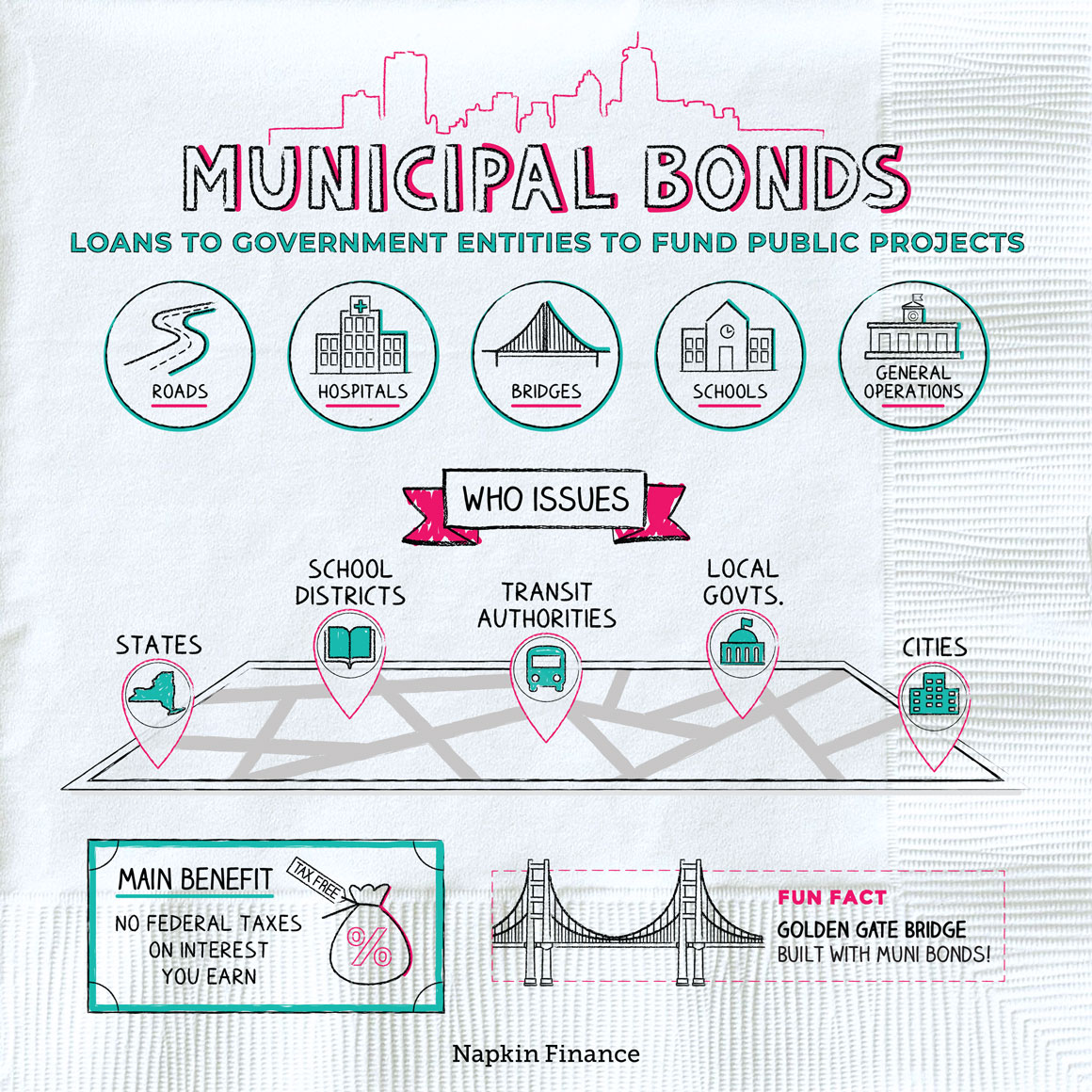

Municipal Bonds Types Uses Benefits Napkin Finance

10 Best Intermediate Municipal Bond Funds For The Long Term

Are Tax Free Muni Bonds Right For Your Portfolio What To Know

The Tax Benefits Of Municipal Bonds Youtube

/GettyImages-1075439388-0c5834aa38c9485ab552acdbe393975e.jpg)

Should You Consider Muni Bonds

U S Fund Flows Set A New Record In The First Half Of 2021 Morningstar

:max_bytes(150000):strip_icc()/dotdash_Final_Everything_You_Need_to_Know_About_Junk_Bonds_Dec_2020-01-5306bf5871c8424bacc317dd8bef5c90.jpg)

Everything You Need To Know About Junk Bonds

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

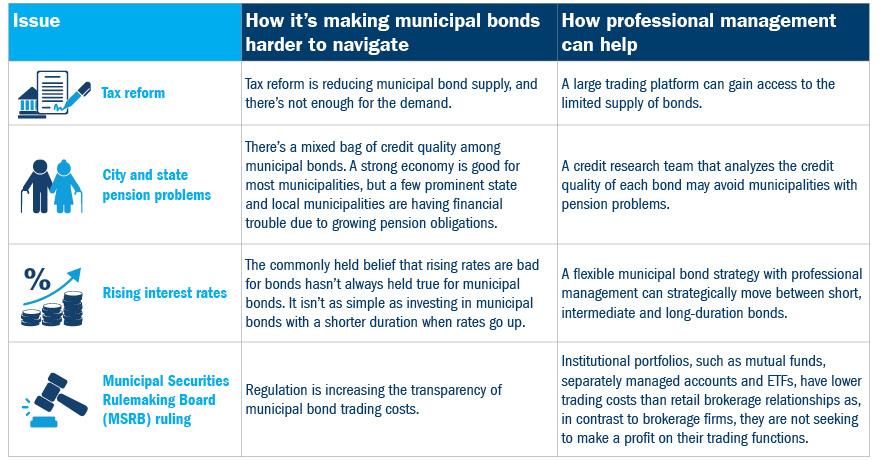

4 Factors Are Changing How To Invest In The Municipal Bond Market Seeking Alpha